The Stacks 2.0 blockchain brings apps and smart contracts to Bitcoin. Proof of Transfer, which connects the Stacks chain to Bitcoin and makes this possible, also makes Stacks (STX) a unique crypto asset. By ‘Stacking’, or locking STX to the network and sending periodic transactions, STX holders actively support PoX consensus, further securing the network and earning bitcoin (BTC) rewards from the protocol for doing so.

Today, we’re excited to share a comprehensive model that allows users to estimate potential earnings based on various assumptions and variables, such as participation rate, the number of miners, transaction fees, as well as others. The economic model is based on community feedback and is intended to help STX holders estimate potential scenarios and earnings for participation. For example, assuming a 50% participation rate in the consensus algorithm with 10 miners or pools (along with certain other assumptions, including assumptions related to the price of BTC and STX), the calculator estimates an earning rate of approximately 9%.

Explore the Model Test Stacking

A better way to earn BTC

We’re excited to provide users a new, more secure way to earn bitcoin without the need to build costly mining setups, leverage 3rd-party DeFi products built on potentially insecure Solidity contracts, or get involved in centralized lending schemes.

The requirements for Stacking are simple: users need to hold a dynamic minimum amount of STX, which they can pool to meet, and ‘lock’ them on the network for the reward cycle, which is approximately two weeks. By locking STX and sending periodic transactions, these users support blockchain consensus and further secure the network. The BTC rewards made available in each cycle come from the BTC that STX Miners forward to the network in hopes of earning the right to mine a new block. Together, Stacking and STX Mining make PoX a more secure alternative to Proof of Stake by extending and building upon Bitcoin’s proof of work.

Stacking over staking

Stacking, unlike some models that revolve around purchasing and then staking Proof-of-Stake tokens to earn a return denominated in the same asset, allows over 300,000 STX holders to earn a reserve currency (BTC) in return for holding a different currency (STX). For DeFi users that commonly convert their earnings back to BTC anyway, this reward and consensus mechanism provides a much more direct way for them to earn BTC and put their crypto to work at the same time.

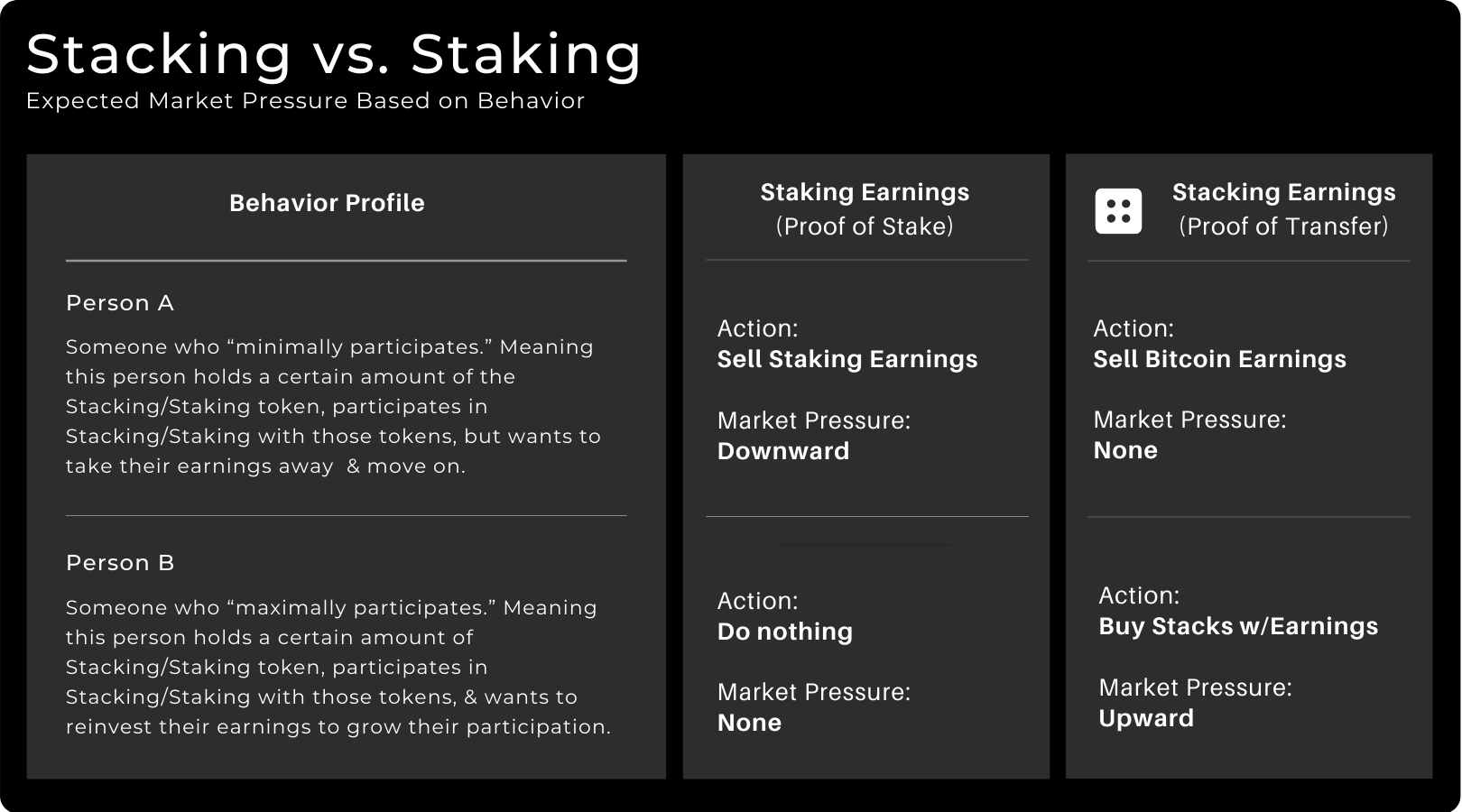

Further, in traditional Proof of Stake systems, users are incentivized to sell assets to cover uptime and maintenance costs. By contrast, Proof of Transfer rewards participants in a more liquid asset (BTC), meaning STX capital markets are not impacted as they might be in traditional Proof of Stake systems.

See below for a brief analysis of expected behavior and potential market pressure in Stacking vs. Staking:

Unlocking the power of Bitcoin

Bitcoin is the crypto asset it seems that many people want to hold, and we’ve seen more Wall Street and institutional investors entering the space. We believe the native connection created by PoX between the Stacks chain and Bitcoin can unlock (a) a Bitcoin-based crypto economy and (b) a crypto web directly on the secure foundation of Bitcoin. We believe this convergence will carve out space for BTC to become a new source of liquidity and the default reserve asset for DeFi.

By enabling users to earn bitcoin and developers to extend Bitcoin without modifying it, we can unlock the potential of the $200B capital and 130 exahashes per second (security) already on Bitcoin. When developers then combine PoX with the Clarity smart contract language developed jointly by Blockstack and Algorand, they can build complex financial products that are powered by and anchored to Bitcoin, while avoiding a reliance on non proof-of-work systems like Polkadot, Tezos, or ETH 2.0.

A simple way to think about it is this: People are trying to bring BTC to Ethereum (e.g. WBTC with ~800M market cap) whereas we’re going the other direction, bringing Ethereum-like functionality to Bitcoin in a more secure, scalable way.

How to get started with Stacking

Stacking functionality, along with all PoX related features, are currently available on testnet, where you can explore the entire mechanism using testnet STX and BTC.

Stacking Guide Testnet Resources

Important disclaimers

This calculator provides only estimates and is provided exclusively for illustrative purposes. Actual results may vary significantly and depend on a large number of unpredictable factors, such as the price of STX, the price of BTC, transaction fees, the number of miners, the number of Stacking participants, and many other factors. You should not rely on this calculator for any financial decisions. Nothing in this communication or the referenced calculator should be in any way construed as an offer or sale of a security or any other financial instrument.

Blockstack PBC is not registered, licensed, or supervised as a broker dealer or investment adviser by the Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), or any other financial regulatory authority or licensed to provide any financial advice or services.